In this post

- What is a no-Closing Costs Financial Refinance?

- As to the reasons Refinance?

- The many benefits of a zero Closing Cost Re-finance

- How In the future Are you willing to Re-finance home financing? Moreira Group Has Solutions

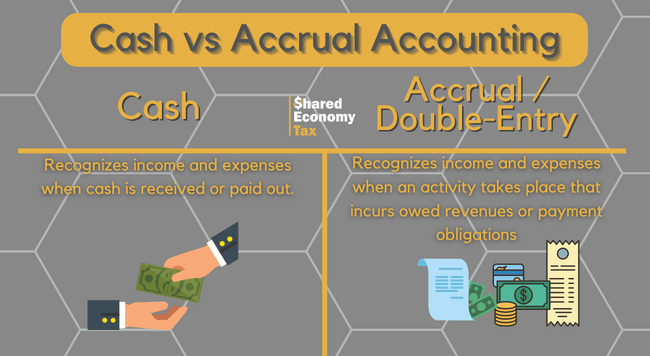

For the majority of homeowners trying to save money and you may consolidate personal debt, refinancing mortgage should be a nice-looking option. However, the price to help you re-finance a home loan may include charges about variety of closing costs. This will establish a stumbling-block when you don’t have adequate liquid assets because of your collateral becoming tied up on the family.

In these instances, a no-closure rates refinance loans Otis helps you protected even more beneficial loan terms and conditions without having to pay with your own money.

Essentially, you don’t spend closing costs immediately after you are approved to suit your the newest mortgage conditions. Instead, the expense you’ll generally pay just like the a borrower could be put into the loan prominent otherwise apply to your rate of interest.

About your re-finance alternatives, secure the economy at heart. Fannie mae today accounts the average 31-year fixed-rate home loan is at six.87% since during the six.4%. Yet not, the newest Federal Set-aside profile several coming incisions so you can home loan cost often feel upcoming in 2010.

While the a homeowner, you may be wanting to know exactly how in the near future you could potentially refinance a mortgage. It is vital to weighing some great benefits of a zero-closure pricing re-finance against the market, along with your qualifications and funds.

As to the reasons Re-finance?

Refinancing offers a massive offers chance for people. Obtaining home financing refinance offer a way to consolidate obligations, with your family equity to pay off almost every other fund, expenses, and expenditures, and put your on the path to financial liberty.

But really, high closing costs tend to act as a shield so you can entry. It include will set you back eg assessment costs, tax and you may name service costs, and bank origination charge, and can exit a lender ground the bill having possibly thousands out-of bucks.

Refinancing enables you to safer a lesser monthly payment of the stretching the duration of your loan, for those who decide to stay-in the newest household long-identity.

You are able to choose a faster shell out-out of and you will a quicker road to expanding your guarantee after you re-finance your own home loan that have a smaller mortgage label.

Refinancing regarding a variable-rate so you’re able to a fixed-rates financial makes you make sure that your monthly installments and you may attract rates are still repaired towards the life of the mortgage, enabling harden your financial believed needs and cover specifications instance repaying financial obligation or renovating to provide equity to your house. Adjustable-price funds can transform towards field, sufficient reason for a predetermined-rate refinance that is one to smaller changeable to worry about.

When rates of interest slide, refinancing makes you benefit from these types of lower rates. As the not everyone has actually money on hands to pay for closing costs, no-closing-cost refinancing is the best choice for the majority.

Often home owners may well not realize that they qualify for top credit software, where an enthusiastic FHA home loan re-finance can also be decrease your monthly payment. Moreira Team might help people know what sort of loans and you can financing programs they be eligible for.

Whenever contemplating exactly how soon you can re-finance a home loan, think about your choice centered on things such as your certificates, latest guarantee and you may property, and you will housing marketplace manner. Although not, when you’ve over your research and have the go out is useful, you will find some key advantageous assets to a zero-closure cost financial refinance.

Closing costs try dos% to help you 5% of one’s amount borrowed typically. This means that on the a loan off $230,000, settlement costs can vary the whole way around $eleven,five-hundred. Needless to say, this may end in some sticker wonder for those who discover it the very first time. A zero-closing rates alternative can also be eradicate it upwards-top prices and build it to the dominating otherwise rate of interest of your mortgage.

Generally speaking, settlement costs mirror the latest legal performs and documentation mixed up in procedure for getting ready the borrowed funds. These types of costs can impact just how in the near future you could refinance home financing. Each one of these items become:

- Reappraisal of your home In many cases, lenders assess the home’s worth so you can determine the worth of your own financing.

- Origination and underwriting fees That it payment is typically calculated due to the fact half the normal commission of overall loan amount, plus it discusses setting-up and you may underwriting the loan, and you will compensating the newest lending experts who aid in this step.

- Taxation and tax charges Closing costs are priced between certain taxes, insurance policies, and you can costs within protecting your loan.

- Government filing fees The town, state, otherwise county will have to document your new facts, that charges protection one procedure.

- Credit history costs The lender will run a credit report in your certification procedure in order to let determine the loan terms and conditions, hence processing payment try put into their closure prices. A 620 credit score or higher is preferred so you can safe a great favorable financing.

As you care able to see, these types of charges can easily accumulate. Even if a zero-closure prices re-finance can truly add this type of costs to your own dominant, lenders can get enable you to decide for using this cost for the interest rate alternatively. Being qualified for a somewhat large rate of interest will keep the primary harmony into the loan about the same, that provides a primary crack-also.

Just how In the future Could you Refinance home financing? Moreira Class Have Responses

When you have thought your options as they are willing to refinance, the new Moreira People can help you dictate the best financing solution to you personally as well as your loved ones.

Our team has the benefit of an entire evaluation of the newest condition because the really since your lending options. We will assess your finances, review your mortgage payments, regulate how debt affects your monthly premiums, and you can factor your own guarantee in the combination. With your items planned, we’re going to have the ability to quote you your prospective the new payment.

The newest Moreira Team has arrived when deciding to take you detail by detail from procedure for refinancing your property. Though against property foreclosure otherwise personal bankruptcy, we’re here to help you get the best package you can.

The Moreira Cluster is able to help you browse the house-to order and you will loan techniques to help you start the next chapter in your life. It’s the purpose to steadfastly keep up visibility you understand each step of the process. Our team gets the experience and information to locate that loan that suits your circumstances on an aggressive speed. Get your custom rate quote today or take the initial step on the homeownership.