For many some body, getting an extra family function owning a secondary house. Unless you have won this new lottery, you will probably you want one minute financial to invest in that, and will are expensive.

Pricing is the reason a holiday family remains a keen hard daydream to own most. Just about everyone can be photo their finest travel household, but pair are able to afford they. Or you will we?

Forbes stated that an average price of a holiday house from inside the 2016 are $200,100000. If you are scarcely cheap, the price does have a look way more attainable than just asked.

Very, how does the next financial really works? As well as how sensible gets acknowledged to find a vacation family? Really, ahead of i diving also deeply into the just how to pick a vacation household, we must know very well what a secondary residence is throughout the eyes out of a loan provider.

What exactly is a holiday Household and are also Financial Costs High toward a second Domestic?

It’s easy to identify a great cabin regarding woods otherwise an excellent property with the coastline since a holiday home. But what if you buy a residential district household just a mile from your current house?

Even although you can be found in a travellers area, it is likely that lenders commonly consider the second family purchase this close to much of your quarters as the an investment property. In reality, of several lenders believe one an additional household be 50 kilometers otherwise more from your own top home so that they can think it over just like the a holiday domestic.

A loan to have a secondary household or investment property are always provides a top interest than just a first house. Although not, a vacation family speed is only a little higher. An investment property price should be 0.5% higher or higher. Thus, if you are planning to acquire a vacation domestic that’s close to much of your house, or otherwise not from inside the an effortlessly understood vacation spot, you might have to do some persuading.

What is a residential property?

It helps that know what an investment property are if you would like confirm that the vacation home is, actually, a holiday household.

An investment property is actually any assets you get towards the intention of earning income toward financial support through renting, another sale of the home or each other.

Which meaning is the perfect place anything can get murky. Extremely properties, throughout the years, enjoy in the worthy of. Thus in theory, every house is an investment property. Ergo additional factors come into play, such as for instance questions regarding people renovations otherwise enhancements you are to make. This is together with where questions relating to the distance from your number one residence and you will implied incorporate may come right up.

Know this: it is unlawful to help you misguide a debtor about your objectives which have property if you intend to profit economically from it. Thus you should never attempt to cheat the computer. Its never ever an intelligent idea.

Ideas on how to Manage loans in Castle Pines a secondary Domestic Deposit

Okay, so your aim are clear, you are to acquire a holiday household and meet up with the meaning and you will requirements. Perfect, let’s start packing therefore we can be relocate.

Your , the latest National Relationship away from Realtors found that 29% out-of vacation homeowners paid off cash. Zero loans, zero programs, simply upright-up bucks.

On top of that, that same survey demonstrated 45% off travel homeowners financed lower than 70% of one’s cost. This means they can generate a big downpayment in the bucks.

Want to provides considerable amounts of cash available to cover a secondary home? It doesn’t hurt. But what these types of numbers very point out would be the fact people just who pick the second home come in a very strong financial situation. In their eyes, running a vacation home is a lot more of a practical alternative than a dream. Whether or not it does not seem like your situation, believe renting a beneficial travel household getting a fortnight from year to year unlike to invest in.

Having fun with a Refi or HELOC for a secondary Domestic Advance payment

Just how do more and more people be able to put such currency off with the a secondary family? The solution is current house collateral.

A popular option is to make use of a cash-aside refinance on the primary where you can find fund the fresh down payment toward a holiday family. This might be feasible if you have gathered enough guarantee both thanks to costs otherwise home well worth fancy.

You may have fun with a house equity credit line (HELOC) and then make a down-payment. The benefit of an effective HELOC is you won’t need to refinance your existing mortgage, so it’s a while convenient and you will faster to do.

Can i Rating Some other Home loan to have the second Home?

The most popular means to fix financing a vacation house is by using a normal mortgage that range out-of ten in order to 30 years in length. The explanation for this is simple: you’ll find less loan software designed for vacation land.

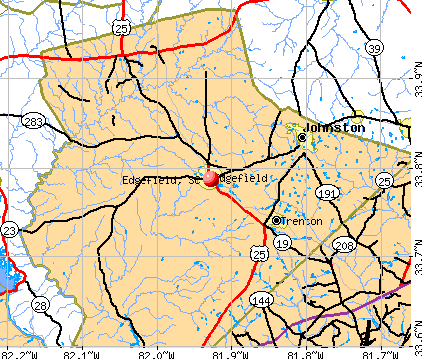

Not as much as the most recent terms, you simply cannot use an enthusiastic FHA loan otherwise a beneficial Virtual assistant mortgage with the vacation home. Those people software merely affect much of your home. Yet not, a USDA loan you will pertain, nonetheless it hinges on where in fact the trips house is receive.

To acquire the second Home to Rent into Airbnb or VRBO?

Whenever try a holiday family maybe not a vacation house? It can be when you decide so you’re able to lease it out. Although not usually.

Let us end up being superior; the holiday home versus. local rental home thing is evolving quickly and also the respond to will would depend for the area, state or county regulations and definitions.

As a rule, a property that you reside in to possess a portion of the season, which can be leased out to have under 180 months will be considered the second house otherwise vacation family. People family that is hired aside getting 180 months or even more is actually an investment property. That’s the income tax definition. Your lender may not agree with so it meaning, neither nearby government.

If you are planning in order to lease your residence aside and use it due to the fact a secondary house, your best circulate should be to contact neighborhood authorities. In the event the vacation house is element of a hotel, flat state-of-the-art otherwise townhome community, you will additionally have to see their legislation. All the more, laws and regulations are set up one to forbids using systems as the rentals.

Your trip House Goals Initiate Here

Even although you can afford a vacation home, an additional home or an investment property, there clearly was one more thing you need – a personal loan officer. Clearly, you have got solutions and you will need help to provide the job. I advise you to find a personal bank loan administrator that’s regional, educated and you will highly committed to your ability to succeed. Handling suitable someone, you are this much closer to having their daydream.