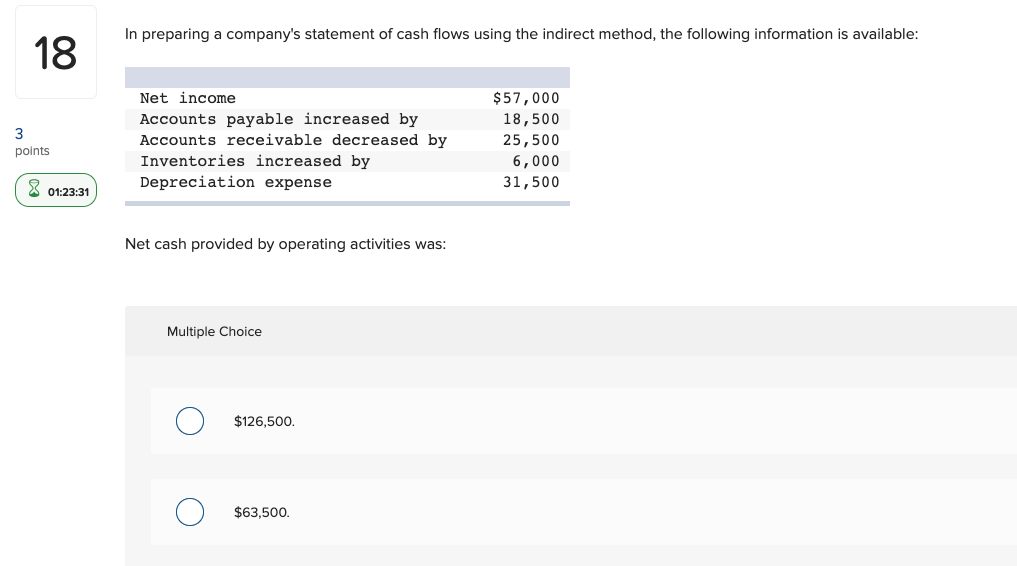

There’s no question your home buying surroundings is hard correct now. Not merely are financial prices at 23-seasons highs , however, other problems, such as for example widespread index shortages and highest home prices in most avenues, are making it tough to have buyers to afford property.

However, when you find yourself these types of affairs make it below perfect for customers, here domestic worth increases during the last number of years has already been good for current property owners. The typical resident is now offering a good number of guarantee within the their home – and is tapped with the which have a house security financing otherwise family equity credit line (HELOC) to fund property restoration, combine large-attention debt otherwise safety unexpected expenses.

Yet not, bringing approved for an excellent HELOC otherwise domestic equity mortgage isnt guaranteed. And you will, sometimes, you may find on your own up against a denial by property equity bank. What can you do if it happens? This is what understand.

Refused a property equity financing? This is what to-do

Bringing declined to possess property collateral loan is going to be a frustrating experience, however, there are lots of steps you can take if this happens, including:

See the cause for the brand new assertion

Step one when planning on taking immediately after becoming rejected a beneficial HELOC otherwise house guarantee financing is always to understand this the lending company denied their app. Lenders typically evaluate multiple issues, together with your credit rating , money, debt-to-earnings proportion plus the number of equity in your home. Demand reveal cause in the bank towards the assertion so you’re able to pinpoint the specific matter that requires dealing with.

Opinion your credit report

A familiar factor in are refused financing is having an effective less-than-finest credit score, making it important to comment yours. Obtain a duplicate of the credit report regarding most of the around three significant credit reporting agencies – Equifax, Experian and you will TransUnion – and you can feedback all of them to possess errors otherwise inaccuracies. If you learn any inaccuracies, conflict them to replace your credit rating.

Change your credit rating

When your credit rating ‘s the major reason with the assertion, it may help to make use of the next techniques to boost they:

- Pay bills promptly: Prompt costs are very very important to maintaining a good credit score, so make sure you shell out the debts punctually every month.

- Dump credit card balances: Lowering your mastercard balance is lower your borrowing application ratio, certainly affecting your credit score.

- Prevent the newest credit programs: Several credit inquiries can damage your credit rating. End obtaining the fresh personal lines of credit.

- Diversify their credit mix: A mixture of different varieties of credit (e.grams., handmade cards, installment funds) will be good for your own score.

- Demand a credit specialist: In the event your borrowing situations try complex, think looking to help from a credit guidance agency.

Re-apply that have a different sort of bank

In case the credit rating advances significantly or if you trust the newest denial is unjustified, envision reapplying having a special lender. Credit requirements may differ, very a getting rejected from one financial doesn’t invariably imply rejection regarding most of the. Just be sure doing pursuit and you can know very well what brand new lenders you’re interested in require basic to maximize the probability off approval.

Talk about alternative financial support solutions

If an effective HELOC or home security mortgage isn’t a choice, you may want to talk about choice money streams. They’re:

- Signature loans: This type of unsecured loans can be used for certain intentions and could not require guarantee.

- Cash-out refinancing: When you find yourself accessible to refinancing all home loan, you might potentially availability a fraction of the home’s guarantee thanks to another type of home loan that have a larger principal harmony. Note, bad credit loans Mccoy whether or not, one a profit-aside re-finance concerns taking right out a separate mortgage having an effective the newest speed to replace your old one to, so if your current home loan enjoys a speed that’s all the way down than what exactly is increasingly being offered, you can even wait about this avenue.

- 401(k) loan: If you have a retirement membership, you will be able to borrow on it, but proceed which have caution to cease charges.

Manage increasing your domestic security

In the event your number of collateral of your home try a limiting foundation, focus on broadening they through the years. This may basically be performed by way of regular mortgage repayments, value of love and strategic renovations. You’ll be able to opt to build big monthly mortgage repayments in order to easily create so much more equity of your home.

The conclusion

Are rejected a beneficial HELOC otherwise family collateral loan might be disappointing, but it doesn’t mean you might be out-of solutions. Bring proactive measures to switch your borrowing from the bank, envision option money procedures and you will discuss an approach to improve house equity. Which have perseverance and mindful financial believed, you could potentially however reach finally your goals and make many of the latest security in your home. Remember that for every single finances is different, so it is required to consult a financial advisor otherwise borrowing from the bank counselor to possess personalized advice considering your needs.

Angelica Einfach are elderly publisher to have Controlling Your finances, where she produces and edits posts on a variety of individual loans information. Angelica previously kept editing spots on Effortless Dollars, Appeal, HousingWire or any other monetary guides.