Very first Franklin Mortgage Believe try created in 2007 and that is situated in Dawson, Georgia. Yet not, they actually do company all over the country, managing money, foundations, and trusts. Basic Franklin Real estate loan Trust is one of many companies you to definitely got advantage of individuals within the subprime home loan crisis. At that time, of a lot people was in fact experiencing underwater mortgages or money one to due more the business value of the house.

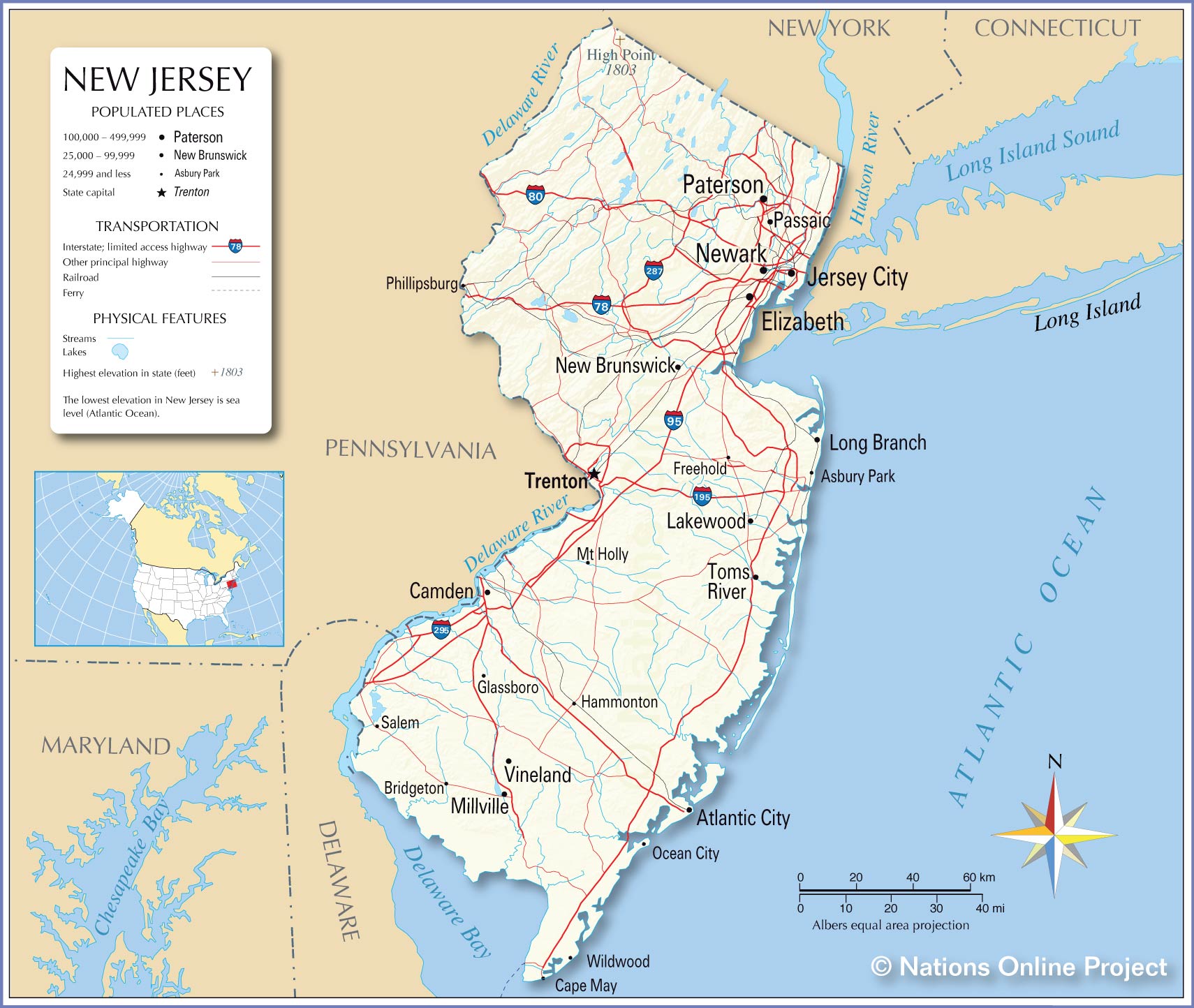

Particularly unnecessary other businesses on these moments, Very first Franklin Mortgage Believe purchased defaulted home loans on large banks and financial institutions. Because this new funds had been under water, the big establishments realized discover pointless in foreclosing into a home without much in order to zero really worth. Therefore, it sold very first and second mortgages with other 3rd-group businesses such as Basic Franklin. First Franklin has never for ages been sincere otherwise fair when trying to get during these loans. Lower than, all of our Fort Lauderdale Very first Franklin Mortgage loan Faith zombie next mortgage foreclosure safeguards attorney teaches you even more.

Preciselywhat are Zombie Next Mortgage Property foreclosure?

An excellent zombie first mortgage property foreclosure occurs when homeowners is actually sent observe your financial is about to foreclose for the home and you may they simply vacate it. New resident thinks property foreclosure try inevitable and so, they get-off the house. Both, this type of foreclosures cases go-ahead but that is not at all times the truth.

2nd home loan foreclosure are very more. An effective zombie second financial foreclosure makes reference to whenever a friends such as for example as the Earliest Franklin Home mortgage Faith purchased that loan of a new business in years past. Whatever the legal requirements in Realities in the Lending Operate, consumers have been never notified you to its loan got moved to Earliest Franklin Home mortgage Believe. Individuals also never ever received see from Basic Franklin Mortgage loan Trust concerning your position of the 2nd financial, which is also unlawful.

Because individuals was basically never ever contacted about the loan, they presumed they certainly were not obligated to spend it. This is especially valid whenever a borrower manages to lose their home owed so you’re able to a foreclosures on the first mortgage. A lot of people presume one to foreclosures does away with second home loan financial obligation because the better, regardless of if that’s not true.

When houses philosophy visited climb up again, Very first Franklin Home mortgage Trust and you may businesses enjoy it reach try to gather into next mortgage loans once more. Because these second mortgages possess relatively risen from the grave,’ he’s called zombie 2nd mortgage loans. Thankfully, the fresh methods First Franklin and other organizations get are illegal, and certainly will act as a protection to suit your needs.

The fresh new Statute out of Limits with the Zombie Next Mortgages

Perhaps one of the most prominent defenses in order to zombie next home loan property foreclosure is the law out-of limitationspanies such as Basic Franklin Home mortgage Believe just have a certain period of time to file a great 2nd mortgage foreclosures suit against borrowers. This will be five years on day of standard. That have second mortgages, the fresh new law out of limitations can begin towards last day’s default. Nevertheless, if Very first Franklin will not document a lawsuit facing you within 5 years regarding last day out of default, they have missing the ability to get it done. This can serve as a shelter, definition you will not getting forced to pay back the debt.

The new law off restrictions is especially important in circumstances associated with zombie next mortgages. Due to the fact that the organization essentially sat during these money to own such a long time instead of following through, almost always there is a good options that statute out of limits enjoys expired.

Indicating Control of Zombie 2nd Mortgage

Almost all of the zombie next mortgage loans are not any prolonged kept, or owned, of the brand-new lender. As mentioned before, most of these loans was indeed bought within the Great Market meltdown or just after. During the time, businesses instance Very first Franklin Mortgage loan Trust was in fact to buy therefore of several bundles of earliest and you may next mortgages which they don’t perform due diligence. They often times failed to make certain that they had ideal documents one to built them given that holder of financing.

If Basic Franklin Home mortgage Believe cannot confirm which they very own the loan, they can not go-ahead that have a foreclosures step. It is also not unusual for the best records to find missing along the way given that an account change give several times. Good Fort Lauderdale foreclosures safety lawyer can be determine if Very first Franklin Home mortgage Faith in reality possesses the loan.

Submitting Bankruptcy proceeding inside Cases of Zombie Next Financial Property foreclosure

As with foreclosures toward first mortgages, you might seek bankruptcy relief from inside the instances of second mortgage property foreclosure. First and foremost, when you file for bankruptcy, the fresh new courtroom commonly issue an automated stay static in your situation. The brand new automated stay forbids financial institutions and you can debt collectors off calling you in an effort to assemble an obligations, hence has 2nd home loan people.

Throughout a part thirteen personal bankruptcy, one debt you owe will be restructured towards a repayment package. Installment plans in these cases offer ranging from three and you may 5 years, which could supply the time you need to repay your own second financial. In the event https://paydayloanalabama.com/coffee-springs/ your home loan on your own residence is however under water, the latest legal may even deem that it is personal debt and you can discharge it, definition you would not lead to investing it.

No body ever before desires file for bankruptcy. However, it will provide the day you should negotiate brand new personal debt otherwise offer a means to take it off, particularly if the most other defenses do not incorporate to suit your needs.

Our Zombie Next Mortgage Foreclosure Safety Attorneys when you look at the Fort Lauderdale Normally Guard Your

Even though you have received a notice off default or foreclosures off First Franklin Home loan Faith does not suggest your have the effect of spending they. Within Loan Solicitors, all of our Fort Lauderdale zombie second home loan foreclosure shelter lawyers can be comment the main points of one’s case and help your dictate an educated street to have shifting. E mail us today in the (954) 523-4357 otherwise e mail us on the internet to help you demand a free of charge consultation and you may for more information.

- About the Author

- Latest Postings

Mortgage Solicitors consists of knowledgeable consumer legal rights lawyer which play with every offered investment to develop complete obligations services measures. Our objective is to accept the individuals burdens, manage the individuals troubles, and invite the website subscribers to bed soundly knowing they are for the the trail so you’re able to a better upcoming.