A smooth query is when a family views your credit history given that a back ground take a look at or to pre-qualify you getting a deal. Interestingly, this can occur which have or rather than your understanding. Soft questions make it financial institutions so you’re able to peek at your borrowing reputation so you can be certain that you’re the ideal debtor, and provide most other organizations the capacity to make sure to features stable financial patterns. It is possible to receive a silky query if you find yourself trying to get a flat otherwise a particular employment.

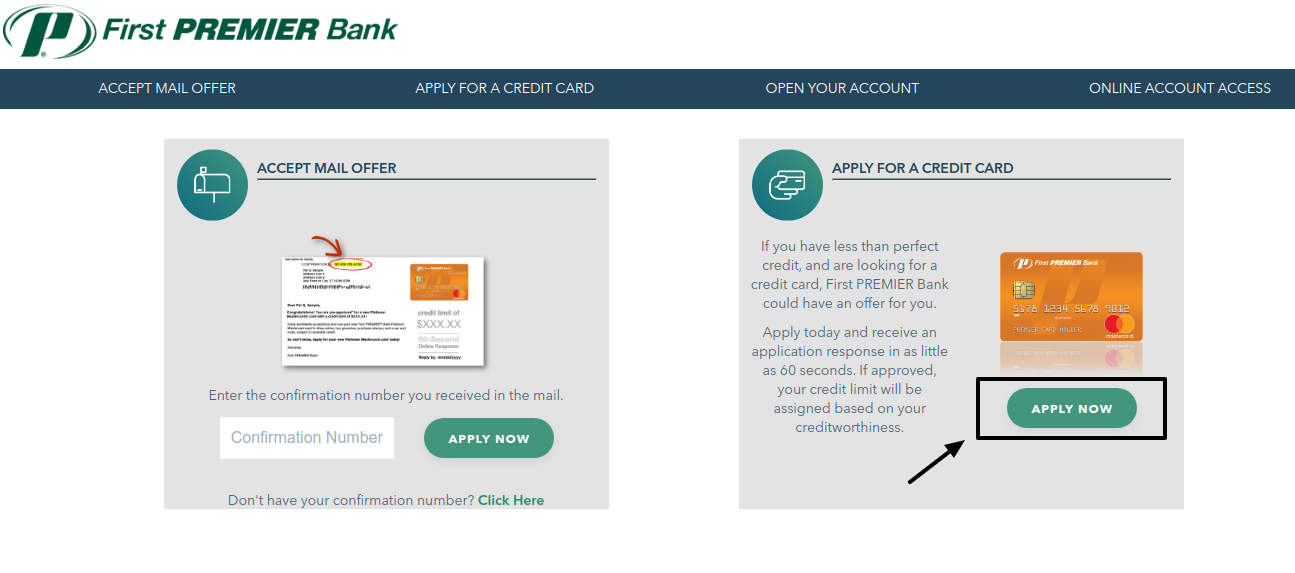

A hard inquiry, called an arduous remove, is when a financial institution instance a lender or credit card issuer monitors your own borrowing to make a financing choice.

You’ll receive a challenging inquiry as soon as you sign up for borrowing if or not it’s credit cards, financial, auto loan, otherwise unsecured loan. Hard concerns show up on your credit score and certainly will straight down your get if you have unnecessary. Tough issues only stick to your credit score for two years, therefore it is better to keep them minimal and you will spaced-out.

Then it hard to do while shopping for an excellent financial otherwise auto loan. When making an application for a car loan at the a car dealership, the sales department will usually check around with numerous lenders from inside the buy to keep the best interest speed for your loan.

Thus several loan providers will give you tough credit issues. The good news is, scoring assistance know about this and can have a tendency to combine the hard borrowing from the bank questions to simply an individual borrowing from the bank remove. So long as the new questions had been all amassed around the same day, they’re able to matter once the an individual when calculating your credit score.

cuatro. Public record information and Choices

Credit agencies are there so you can report the good and bad with regards to your credit score. If you have got a free account delivered to choices getting low-payment or have any public information together with bankruptcies otherwise civil lawsuits, this can show up on your credit history too.

Fico scores

A credit rating are a beneficial around three-thumb matter (generally ranging from three hundred and 850) which is according to a installment loan Nevada diagnosis of your creditworthiness. To phrase it differently, it’s lots you to find the amount to which some body is actually a responsible debtor.

Loan providers make use of your credit score to gain a simple answer to these inquiries, as well as your score was a top basis whenever deciding whether or not you can easily getting recognized otherwise rejected for new borrowing.

You can find about three chief credit bureaus: Experian, Equifax, and you may TransUnion. Such about three enterprises collect study that can help know very well what appears to the your credit score. But not, brand new bureaus on their own usually do not necessarily create your credit rating. Rather, they normally use many credit rating models in order to make your get, all of these differ quite on what economic factors they grounds as well as how the individuals elements try calculated.

What exactly is for the a credit score?

You can find plenty circumstances one to sign up to the borrowing get. not, specific keep more excess weight as opposed to others on the vision away from a financial.

A major get formula, FICO, works out four fundamental monetary points, for every with yet another lbs. Considering MyFico, fico scores was calculated that with four head affairs.

Clearly, only a couple of things are more sixty% of FICO get computation. Demonstrably payment records and you will levels due features a large effect on how loan providers anticipate the precision. When you yourself have plenty of account with high stability, are making late payments, otherwise don’t spend during particular days, most of the record would be found in your declaration, and can even lower your credit score.