The rate offered, and you can charges and you will charges relies upon our assessment of good level of points at the time of software along with:

- The level of their put or current collateral (when the refinancing)

- Character of your defense property (or the possessions you really have security into the if the refinancing)

- Loan in order to well worth ratio (LVR)

- Your earnings

- Credit history

- Any property you possess

- People obligations or credit financial obligation

- Selected payment variety of settling desire-merely, or prominent and attention

- The objective of the borrowed funds if it is for a holder-occupier or investment property

To find an an indication interest rate?, you can begin by using our very own on the internet borrowing from the bank power calculator, or speak to our Credit Professionals with the 137 377.

You might combine a number of bills into the mortgage provided new integration throws your in the a better financial condition. We could move to consolidate different varieties of personal debt into your new house loan, and https://clickcashadvance.com/installment-loans-al/hamilton/ credit cards, signature loans, car and truck loans, personal fund, tax or any other personal otherwise company bills. Before you get carried away consolidating every a good costs in the mortgage, see the keeps and you may limits of loan product you are searching at the because the specific competitive interest circumstances may have constraints into amount of costs which might be consolidated.

What is debt consolidation?

Debt consolidation pertains to taking out fully just one loan to help you consolidate numerous expense, instance mastercard costs, college loans, or other a great money. It is an alternative that will help you better manage your costs. By merging numerous bills towards you to definitely mortgage, you might take advantage of lower monthly payments, faster, otherwise got rid of later fees, plus the convenience of which have one financing to cope with.

Consolidation finance are available of each other financial institutions and you may non-financial lenders, for every are certain to get additional fine print. Deciding the best financial for the ideal borrower is dependent on the personal affairs. It is essential to evaluate the expenses and you will benefits associated with each financing provider and select one which meets your needs.

How come debt consolidating work?

Debt consolidation works by taking your entire current debts to each other and you will moving all of them toward just one financing account, commonly having down month-to-month costs. However when provided debt consolidation, you should see the specifics of how it work away to you personally plus condition.

Combining the money you owe can lead to a lowered interest rate than your personal costs, resulting in deals along the life of the borrowed funds. Essentially your debt combination loan will receive lower monthly repayments than simply the amount are paid down to your full expenses currently due.

Do i need to consolidate my personal debt which have home financing?

If you have security of your home financing, you happen to be in a position to control it so you can consolidate almost every other expense in the financing.

One benefit out-of combining low-assets debt to the home financing is you can usually get a lower life expectancy interest. Because you will end up being placing your house upwards because equity, loan providers will provide lower rates than just they will toward other sorts of funds.

Can i spend stamp obligation once i refinance?

If you’re looking so you’re able to refinance the loan in australia, your p duty. This is essentially a one-off percentage energized of the your state otherwise Territory regulators with the specific sorts of purchases. It is important to seek the advice of the appropriate State or Region Stamp Obligation Work environment in the event the stamp duty applies on the types of problem.

How do i re-finance having Pepper Currency?

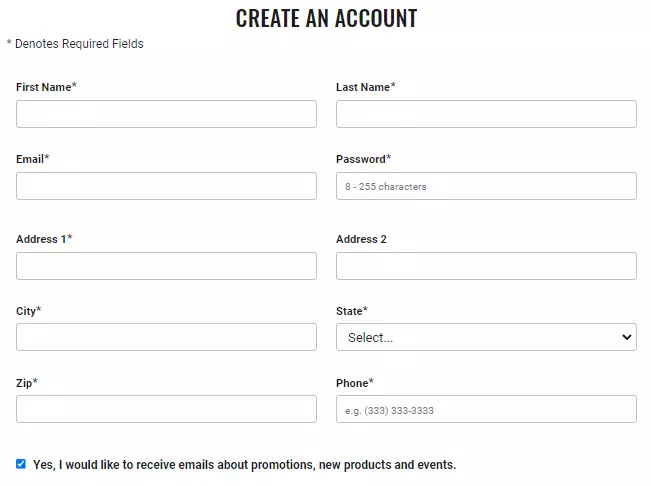

Refinancing a home loan with our company is not difficult. You can use on the internet and finish the processes within just 20 minutes when you’re an eligible consumer with Pay as you go Income. Most useful yet, you’re getting your own an indicator desire rate? before applying versus affecting your credit score.